Content

Organized, nationalEXCHANGESwhere securities, options, and futures contracts are traded by members for their own accounts and for the accounts of customers. ATAXthat is levied by a state or city government on the retailsaleof goods and services. Inportfoliotheory and capitalbudgetanalysis, the rate necessary to determine thePRESENT VALUEof an uncertain or risky stream ofINCOME; it is the RISK-free rate plus a riskpremiumthat is based on an analysis of the risk characteristics of the particularINVESTMENTor project. Sales of products,merchandise, and services; and earnings fromINTEREST, DIVIDEND, rents. A useful measure of overall operational efficiency when compared with the prior periods or with other companies in the same line of business. If for aCORPORATIONthere are seven statutory options forreorganizationthat would cause the corporation and shareholders to not recognize anyGAINorLOSSon the exchange of stock.

- Professional and consultant services are generally acquired to obtain information, advice, opinions, alternatives, conclusions, recommendations, training, or direct assistance, such as studies, analyses, evaluations, liaison with Government officials, or other forms of representation.

- A 10-20% overage might be considered reasonable, especially if the contractor discovered issues along the way that he couldn’t have been aware of initially .

- For purposes of this section, net positive overhead variance means the excess of total standard indirect costs over total actual indirect costs and net negative overhead variance means the excess of total actual indirect costs over total standard indirect costs.

- Surcharges assessed to you will vary depending on the type of Service and the Rate Plan you have.

Writing checks against a bankaccountwith insufficient funds to cover them, hoping that the bank will receive deposits before the checks arrive for clearance. Considered “non-investmentgrade” bonds, these SECURITIES ordinarilyyielda higher rate ofinteresttocompensatefor the additional risk. A customer order for a specific number of specially designed, made-to-order products. Circumstance where https://online-accounting.net/ loans in excess of ACCOUNTS RECEIVABLE are made againstinventoryin anticipation of future sales. Accountat a bank, savings andloanassociation,creditunion, or brokeragefirmthat belongs to a federal or private insuranceorganization. Formal agreement, also called a deed oftrust, between anissuerof bonds and theBONDHOLDERcovering certain considerations such as form of the BOND for example.

Examples of Costs in Excess of Billings in a sentence

However, the implementation of such a concept in the past decade has received mixed results. Instead of inviting competitive bidding, private owners often choose to award construction contracts with one or more selected contractors. A major reason for using negotiated contracts is the flexibility of this type of pricing arrangement, particularly for projects of large size and great complexity or for projects which substantially duplicate previous facilities sponsored by the owner. An owner may value the expertise and integrity of a particular contractor who has a good reputation or has worked successfully for the owner in the past.

However, application of cost principles to fixed-price contracts and subcontracts shall not be construed as a requirement to negotiate agreements on individual elements of cost in arriving at agreement on the total price. The final price accepted by the parties reflects agreement only on the total price. Further, notwithstanding the mandatory use of cost principles, the objective will continue to be to negotiate prices that are fair and reasonable, cost and other factors considered. Pension plan means a deferred compensation plan established and maintained by one or more employers to provide systematically for the payment of benefits to plan participants after their retirements, provided that the benefits are paid for life or are payable for life at the option of the employees. Additional benefits such as permanent and total disability and death payments, and survivorship payments to beneficiaries of deceased employees, may be an integral part of a pension plan.

Governmental Accounting Standards Board (GASB)

When the contractor can demonstrate that failure to take cash discounts was reasonable, the contractor does not need to credit lost discounts. To be allowable, PRB costs must be funded by the time set for filing the Federal income tax return or any extension thereof, or paid to an insurer, provider, or other recipient by the time set for filing the Federal income tax return or extension thereof. PRB costs assigned to the current year, but not funded, paid or otherwise liquidated by the tax return due date as extended are not allowable in any subsequent year. Once an appropriate base for allocating indirect costs has been accepted, the contractor shall not fragment the base by removing individual elements. All items properly includable in an indirect cost base shall bear a pro rata share of indirect costs irrespective of their acceptance as Government contract costs.

What does cost in excess of billings mean?

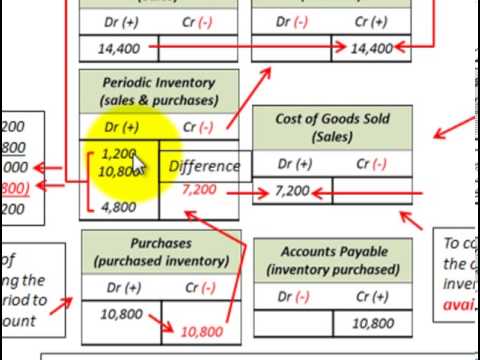

A project is ‘underbilled’ (Costs in Excess of Billings) when the cost of work completed so far exceeds the amount of revenue that has been billed to the client. On the balance sheet, underbillings are assets because they represent future revenue to be billed on work that has already been completed.

Consultants’ work products and related documents, such as trip reports indicating persons visited and subjects discussed, minutes of meetings, and collateral memoranda and reports. The nature and scope of the service rendered in relation to the service required. Services that are intended to improperly influence the contents of solicitations, the evaluation of proposals or quotations, or the selection of sources for contract award, whether award is by the Government, or by a prime contractor or subcontractor. Other costs in connection with the filing and prosecution of a United States patent application where title or royalty-free license is to be conveyed to the Government. Existing procedures should be utilized to resolve in advance any significant questions or disagreements concerning the interpretation or application of this subsection. Costs allowed for business interruption or other similar insurance shall be limited to exclude coverage of profit.

Law firm billing codes

If you call 911 using a T-Mobile VoIP service, we may transmit Your E911 Registered Address to the 911 Communications Center that answers the call, and it may be used to help emergency responders locate you. You agree to update Your E911 Registered Address before you use your T-Mobile VoIP service at a different location. You can update your E911 Registered Address by accessing your MyT-Mobile.com account or by contacting T-Mobile Customer Care.

- An Authorized User will need to verify identity before we provide access to account information.

- If we accept late or partial payments, you still must pay us the full amount you owe, including late fees.

- Activities that relate to offering a privatecompany’s shares to the generalinvestingpublic including registering with theSEC.

- The director of administrative services shall furnish to the director of budget and management all necessary data for drawing state official and employee pay warrants and preparing earning statements.

- The director shall administer the fund for the benefit of recycling programs in state agencies.

- The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles.

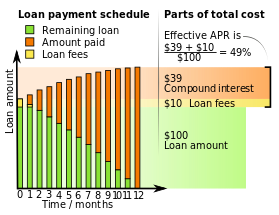

There’s some flexibility with how to present and disclose retainage, receivables, contract assets, and contract liabilities in a company’s financial statements in accordance with Topic 606. The following are a couple of options we’ve seen that provide the desired transparency for financial statement users in the construction industry. Exhibit 4 provides significant information about retainage on the face of the balance sheet, while Exhibit 5 provides more detailed information in the footnotes. Loss Adjustment Expenses means all costs and expenses incurred by the Company in the investigation, adjustment and settlement of claims.

National Association of State Boards of Accountancy (NASBA)

For owners of closely held companies, compensation in excess of the costs that are deductible as compensation under the Internal Revenue Code ( 26 U.S.C.) and regulations under it is unallowable. The total compensation for individual employees or job classes of employees must be reasonable for the work performed; however, specific restrictions on individual compensation elements apply when prescribed. Costs of bonding required by the contractor in the general conduct of its business are allowable to the extent that such bonding is in accordance with sound business practice and the rates and premiums are reasonable under the circumstances. In the absence of an advance agreement, if an initial review of the facts results Cost in Excess of Billings Law and Legal Definition in a challenge of the statistical sampling methods by the contracting officer or the contracting officer’s representative, the burden of proof shall be on the contractor to establish that such a method meets the criteria in paragraph of this subsection. Any large dollar value or high risk transaction is separately reviewed for unallowable costs and excluded from the sampling process. Advance agreements may be negotiated with a particular contractor for a single contract, a group of contracts, or all the contracts of a contracting office, an agency, or several agencies. Advance agreements may be negotiated either before or during a contract but should be negotiated before incurrence of the costs involved.

Such a purchase does not constitute failure to comply with the biobased product preference program or preclude the agency or institution from otherwise participating in the program. The director of administrative services shall adopt rules regarding circumstances and criteria for obtaining a release and permit under this section. The director of administrative services shall prescribe uniform rules governing forms of specifications, advertisements for proposals, the opening of bids, the making of awards and contracts, and the purchase of supplies and performance of work. “Services” means the furnishing of labor, time, or effort by a person, not involving the delivery of a specific end product other than a report which, if provided, is merely incidental to the required performance. “Services” does not include services furnished pursuant to employment agreements or collective bargaining agreements. “Purchase” means to buy, rent, lease, lease purchase, or otherwise acquire supplies or services. “Purchase” also includes all functions that pertain to the obtaining of supplies or services, including description of requirements, selection and solicitation of sources, preparation and award of contracts, all phases of contract administration, and receipt and acceptance of the supplies and services and payment for them.

New York Stock Exchange (NYSE)

Saleof property by a seller who simultaneously leases the property back from the purchaser. Concept in statutes and regulations whereby a person who meets listed requirements will be preserved from adverse legal action. Frequently, safe harbors are used where a legal requirement is somewhat ambiguous and carries ariskof punishment for an unintended violation. DEBTOR’S legal right, to discharge all or a portion of theDEBTowed to another party by applying against the debt an amount that the other party owes to the debtor.